|

|

|

Illicit drug use costs the United States approximately $181 billion every year.

The training of an anesthesiologist typically requires four years of college, 4 years of medical school, 1 year of internship, and 3 years of residency.

An identified risk factor for osteoporosis is the intake of excessive amounts of vitamin A. Dietary intake of approximately double the recommended daily amount of vitamin A, by women, has been shown to reduce bone mineral density and increase the chances for hip fractures compared with women who consumed the recommended daily amount (or less) of vitamin A.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.

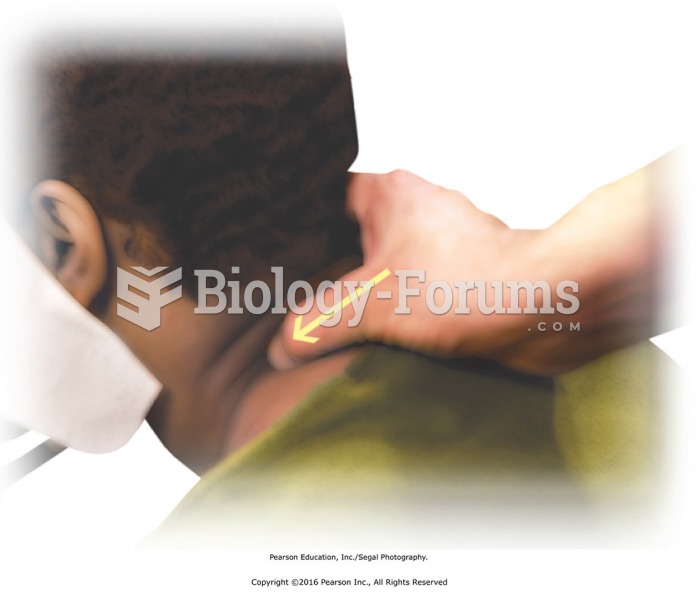

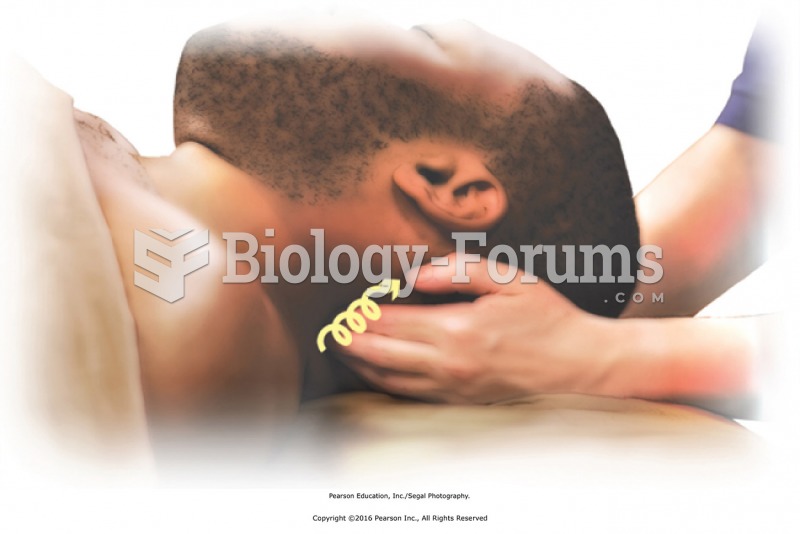

Apply circular friction to the left side of the neck along cervical muscles with the fingertips of ...

Apply circular friction to the left side of the neck along cervical muscles with the fingertips of ...

Mobilize the ankle using the heels of the hands. Place a palm on either side of the ankle just below ...

Mobilize the ankle using the heels of the hands. Place a palm on either side of the ankle just below ...