|

|

|

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

Parkinson's disease is both chronic and progressive. This means that it persists over a long period of time and that its symptoms grow worse over time.

Most strokes are caused when blood clots move to a blood vessel in the brain and block blood flow to that area. Thrombolytic therapy can be used to dissolve the clot quickly. If given within 3 hours of the first stroke symptoms, this therapy can help limit stroke damage and disability.

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.

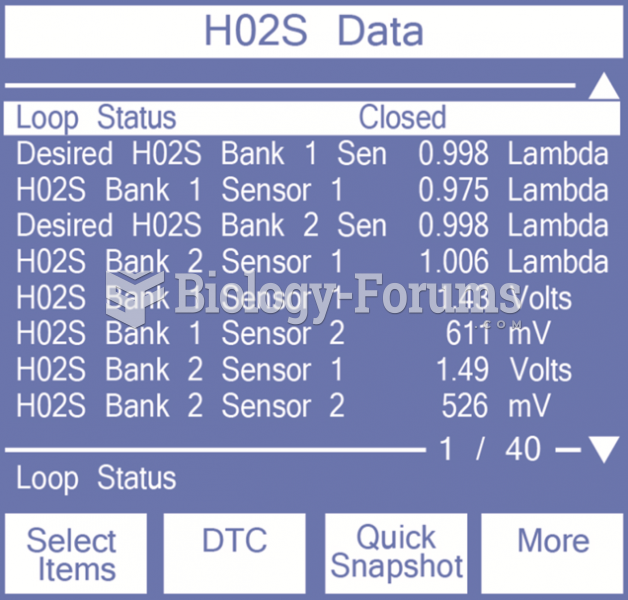

The target lambda on this vehicle is slightly lower than 1.0 indicating that the PCM is attempting ...

The target lambda on this vehicle is slightly lower than 1.0 indicating that the PCM is attempting ...

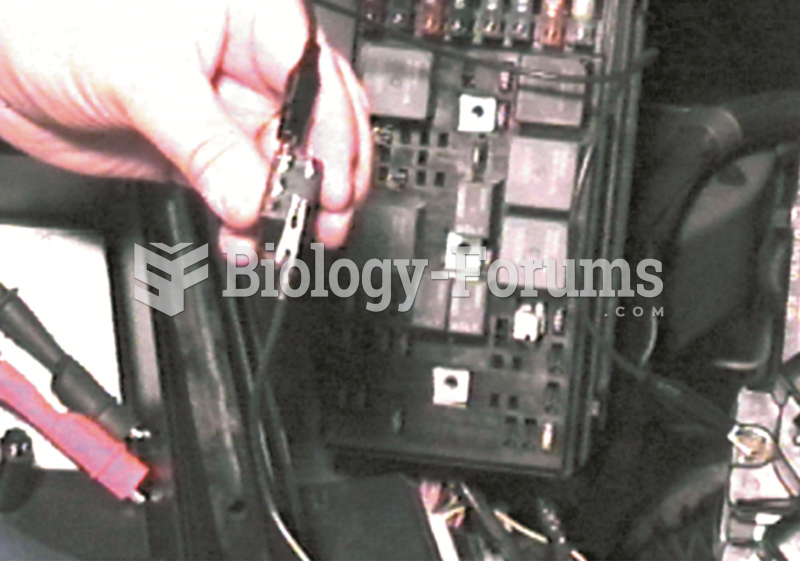

Connect a fused jumper wire to supply 12 volts to terminal 86 and a ground to terminal 85 of the ...

Connect a fused jumper wire to supply 12 volts to terminal 86 and a ground to terminal 85 of the ...