|

|

|

Adults are resistant to the bacterium that causes Botulism. These bacteria thrive in honey – therefore, honey should never be given to infants since their immune systems are not yet resistant.

More than 150,000 Americans killed by cardiovascular disease are younger than the age of 65 years.

Women are two-thirds more likely than men to develop irritable bowel syndrome. This may be attributable to hormonal changes related to their menstrual cycles.

Acute bronchitis is an inflammation of the breathing tubes (bronchi), which causes increased mucus production and other changes. It is usually caused by bacteria or viruses, can be serious in people who have pulmonary or cardiac diseases, and can lead to pneumonia.

GI conditions that will keep you out of the U.S. armed services include ulcers, varices, fistulas, esophagitis, gastritis, congenital abnormalities, inflammatory bowel disease, enteritis, colitis, proctitis, duodenal diverticula, malabsorption syndromes, hepatitis, cirrhosis, cysts, abscesses, pancreatitis, polyps, certain hemorrhoids, splenomegaly, hernias, recent abdominal surgery, GI bypass or stomach stapling, and artificial GI openings.

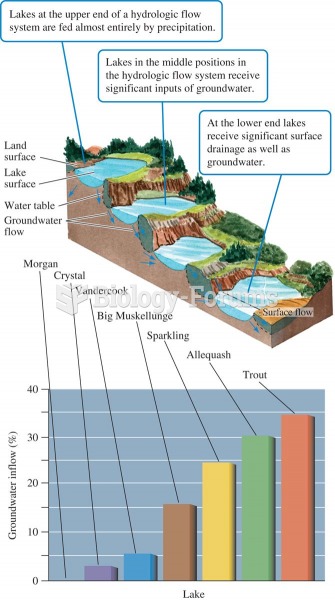

Lake position in the landscape and proportion of water received as groundwater (data from Webster et

Lake position in the landscape and proportion of water received as groundwater (data from Webster et

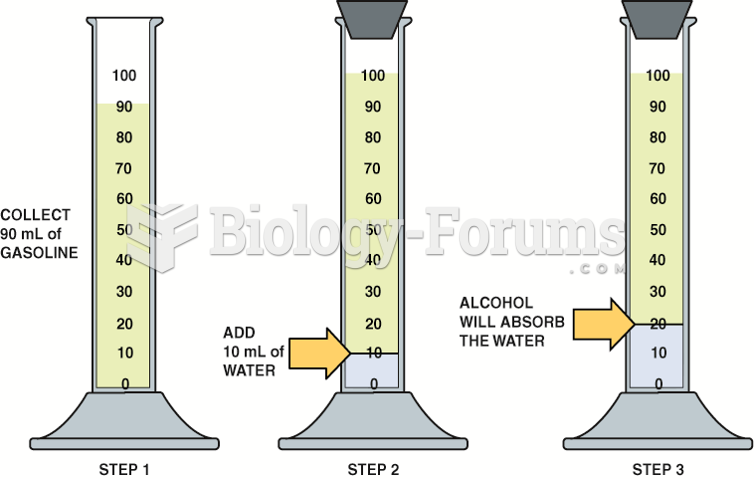

Checking gasoline for alcohol involves using a graduated cylinder and adding water to check if the ...

Checking gasoline for alcohol involves using a graduated cylinder and adding water to check if the ...