|

|

|

Serum cholesterol testing in adults is recommended every 1 to 5 years. People with diabetes and a family history of high cholesterol should be tested even more frequently.

Your chance of developing a kidney stone is 1 in 10. In recent years, approximately 3.7 million people in the United States were diagnosed with a kidney disease.

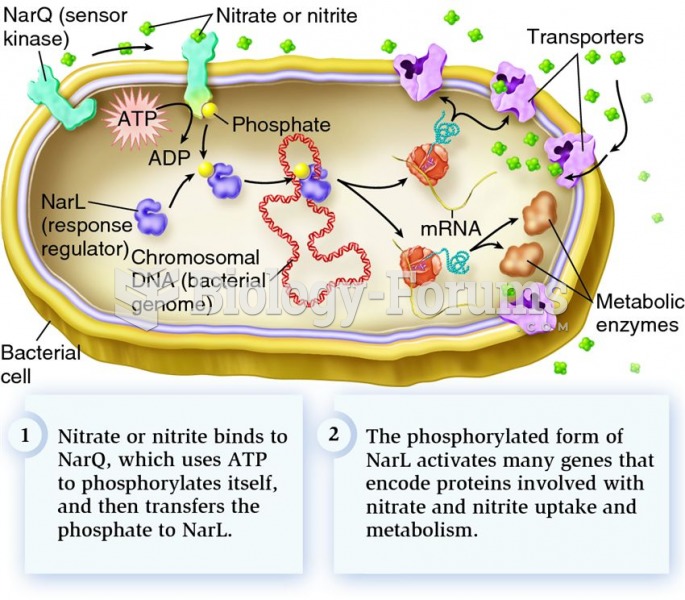

Bacteria have flourished on the earth for over three billion years. They were the first life forms on the planet.

More than 20 million Americans cite use of marijuana within the past 30 days, according to the National Survey on Drug Use and Health (NSDUH). More than 8 million admit to using it almost every day.

More than 2,500 barbiturates have been synthesized. At the height of their popularity, about 50 were marketed for human use.