|

|

|

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

The first monoclonal antibodies were made exclusively from mouse cells. Some are now fully human, which means they are likely to be safer and may be more effective than older monoclonal antibodies.

The most common childhood diseases include croup, chickenpox, ear infections, flu, pneumonia, ringworm, respiratory syncytial virus, scabies, head lice, and asthma.

The horizontal fraction bar was introduced by the Arabs.

As many as 28% of hospitalized patients requiring mechanical ventilators to help them breathe (for more than 48 hours) will develop ventilator-associated pneumonia. Current therapy involves intravenous antibiotics, but new antibiotics that can be inhaled (and more directly treat the infection) are being developed.

John Lewis Krimmel’s painting of the Fourth of July in Centre Square Philadelphia (1812) shows the d

John Lewis Krimmel’s painting of the Fourth of July in Centre Square Philadelphia (1812) shows the d

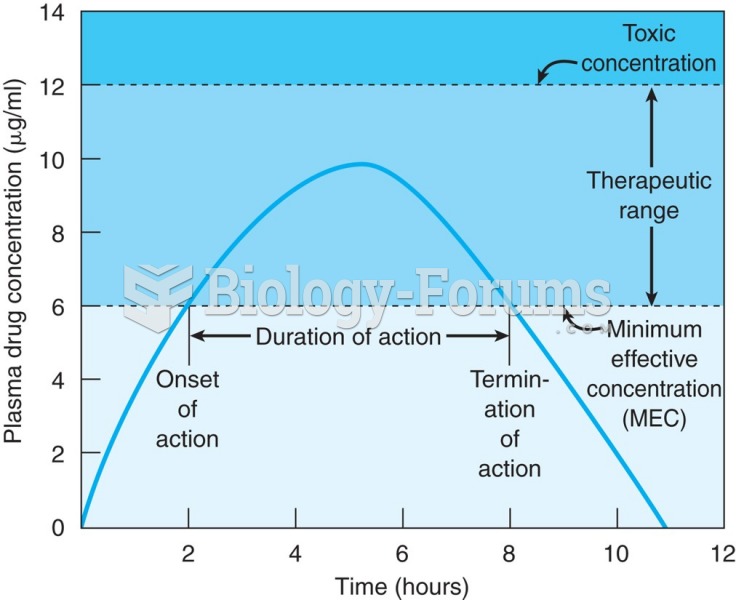

Graph showing oral administration of a single-dose drug. The time of onset is 2 hours and the end of ...

Graph showing oral administration of a single-dose drug. The time of onset is 2 hours and the end of ...