|

|

|

Multiple experimental evidences have confirmed that at the molecular level, cancer is caused by lesions in cellular DNA.

It is important to read food labels and choose foods with low cholesterol and saturated trans fat. You should limit saturated fat to no higher than 6% of daily calories.

ACTH levels are normally highest in the early morning (between 6 and 8 A.M.) and lowest in the evening (between 6 and 11 P.M.). Therefore, a doctor who suspects abnormal levels looks for low ACTH in the morning and high ACTH in the evening.

Opium has influenced much of the world's most popular literature. The following authors were all opium users, of varying degrees: Lewis Carroll, Charles, Dickens, Arthur Conan Doyle, and Oscar Wilde.

The effects of organophosphate poisoning are referred to by using the abbreviations “SLUD” or “SLUDGE,” It stands for: salivation, lacrimation, urination, defecation, GI upset, and emesis.

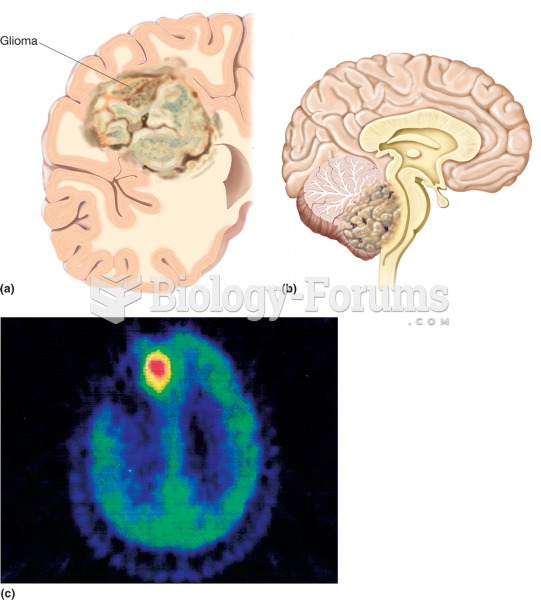

Glioma. (a) Illustration of a large glioma (colored area) within the left cerebral hemisphere in a s

Glioma. (a) Illustration of a large glioma (colored area) within the left cerebral hemisphere in a s

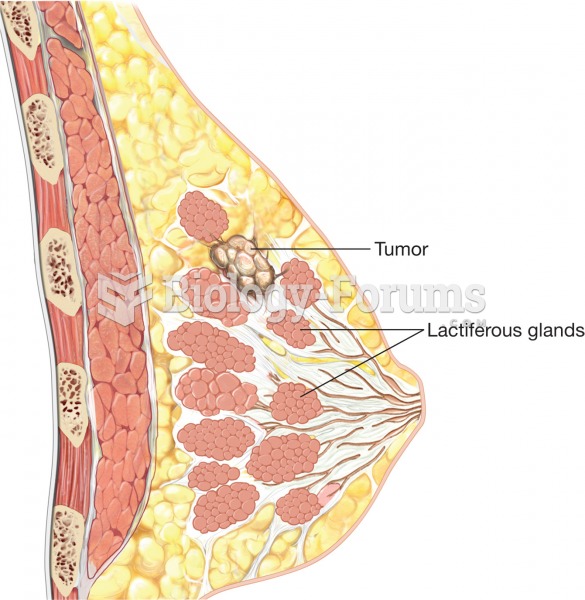

Breast cancer. Notice the tumor growing within a lactiferous gland, which occurs in infiltrating duc

Breast cancer. Notice the tumor growing within a lactiferous gland, which occurs in infiltrating duc