|

|

|

Nearly all drugs pass into human breast milk. How often a drug is taken influences the amount of drug that will pass into the milk. Medications taken 30 to 60 minutes before breastfeeding are likely to be at peak blood levels when the baby is nursing.

Human neurons are so small that they require a microscope in order to be seen. However, some neurons can be up to 3 feet long, such as those that extend from the spinal cord to the toes.

Glaucoma is a leading cause of blindness. As of yet, there is no cure. Everyone is at risk, and there may be no warning signs. It is six to eight times more common in African Americans than in whites. The best and most effective way to detect glaucoma is to receive a dilated eye examination.

In women, pharmacodynamic differences include increased sensitivity to (and increased effectiveness of) beta-blockers, opioids, selective serotonin reuptake inhibitors, and typical antipsychotics.

The most common treatment options for addiction include psychotherapy, support groups, and individual counseling.

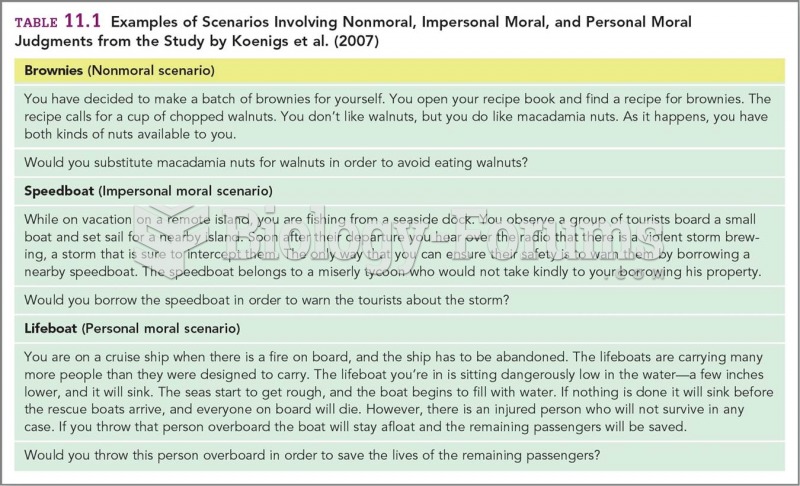

Examples of Scenarios Involving Nonmoral, Impersonal Moral, and Personal Moral Judgments from the St

Examples of Scenarios Involving Nonmoral, Impersonal Moral, and Personal Moral Judgments from the St

Older people who experienced stressful events in their younger years may show personal growth and ...

Older people who experienced stressful events in their younger years may show personal growth and ...