|

|

|

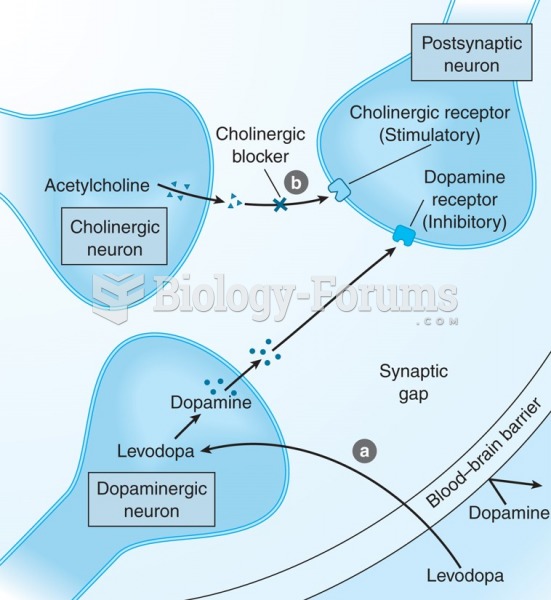

A recent study has found that following a diet rich in berries may slow down the aging process of the brain. This diet apparently helps to keep dopamine levels much higher than are seen in normal individuals who do not eat berries as a regular part of their diet as they enter their later years.

The cure for trichomoniasis is easy as long as the patient does not drink alcoholic beverages for 24 hours. Just a single dose of medication is needed to rid the body of the disease. However, without proper precautions, an individual may contract the disease repeatedly. In fact, most people develop trichomoniasis again within three months of their last treatment.

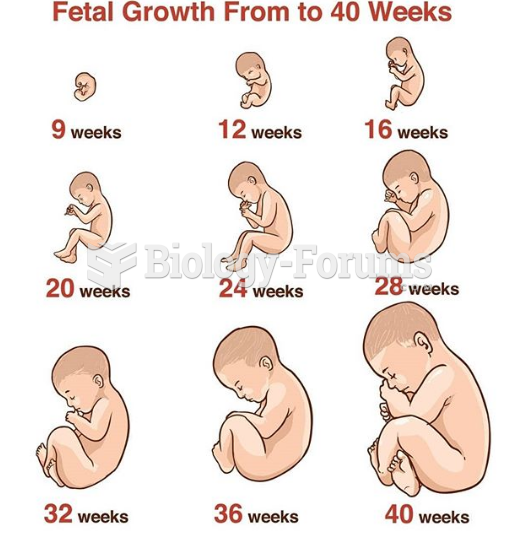

Egg cells are about the size of a grain of sand. They are formed inside of a female's ovaries before she is even born.

If all the neurons in the human body were lined up, they would stretch more than 600 miles.

The familiar sounds of your heart are made by the heart's valves as they open and close.

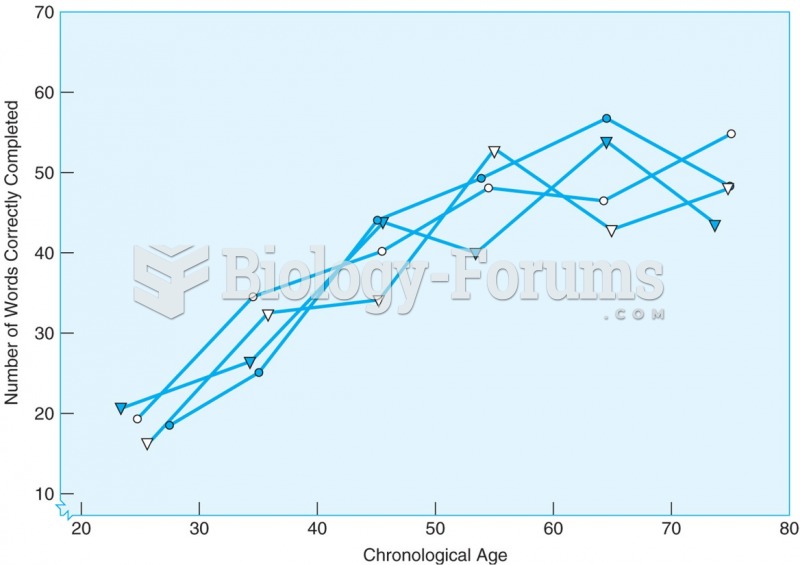

The number of words correctly completed in the New York Times crossword puzzle increases with age ...

The number of words correctly completed in the New York Times crossword puzzle increases with age ...

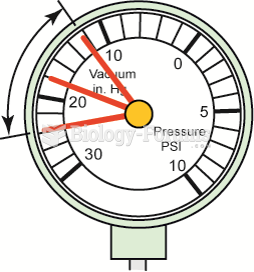

Weak valve springs will produce a normal reading at idle, but as engine speed increases, the needle ...

Weak valve springs will produce a normal reading at idle, but as engine speed increases, the needle ...