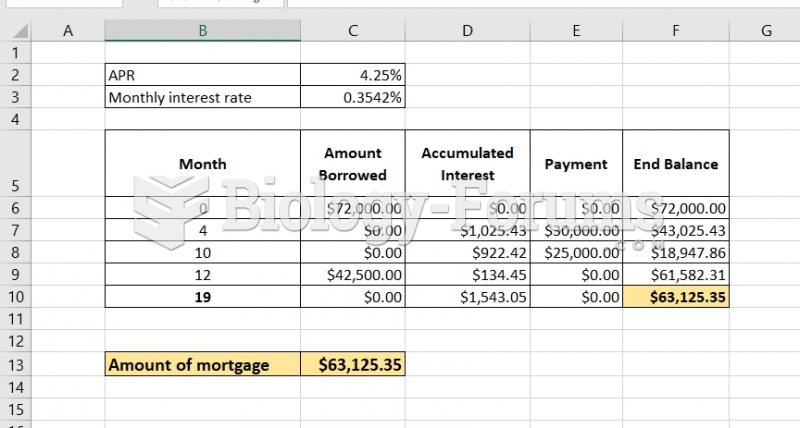

American Savings and Loan Association (American) held a first deed of trust on certain incomeproducing property. The deed of trust had a dueonsale clause. American permitted several transfers without requiring an increase in the interest rate due on the underlying obligation. Mr. Witter was one of the transferees of the property and he had defaulted on the American deed of trust as well as on a second deed of trust held by Mr. Master (Mr. Witter's seller). American permitted Master to foreclose with the understanding that after Master acquired title to the property, there would be no increase in interest rates for a limited period during which Master would dispose of the property. Master failed to inform American that when he acquired title, he entered into an agreement with Mr. Medovi and carried a second deed of trust on the property. Medovi's broker, Mr. Glick, carried a third deed of trust on the property. When American discovered Master's action, it told Medovi he could assume the loan provided the interest rate was increased to market levels. Medovi refused to pay, and American commenced foreclosure. Did American act properly? Why or why not?

Question 2

Consider the following grant: This transfer or deed is made with the full understanding that should the property fail to be used for the Church of God, it is to be null and void and property to revert to W. E. Collins or heirs. Discuss the interests created.