|

|

|

Did you know?

The most common childhood diseases include croup, chickenpox, ear infections, flu, pneumonia, ringworm, respiratory syncytial virus, scabies, head lice, and asthma.

Did you know?

It is difficult to obtain enough calcium without consuming milk or other dairy foods.

Did you know?

The familiar sounds of your heart are made by the heart's valves as they open and close.

Did you know?

As of mid-2016, 18.2 million people were receiving advanced retroviral therapy (ART) worldwide. This represents between 43–50% of the 34–39.8 million people living with HIV.

Did you know?

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

Lie prone with your head turned to one side. Put your arms out to your sides and bend your elbows at ...

Lie prone with your head turned to one side. Put your arms out to your sides and bend your elbows at ...

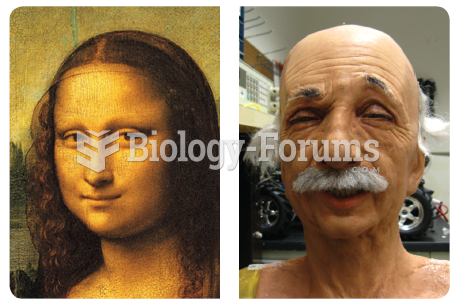

The asymmetry of facial expressions. Notice that the expressions are more obvious on the left side ...

The asymmetry of facial expressions. Notice that the expressions are more obvious on the left side ...