|

|

|

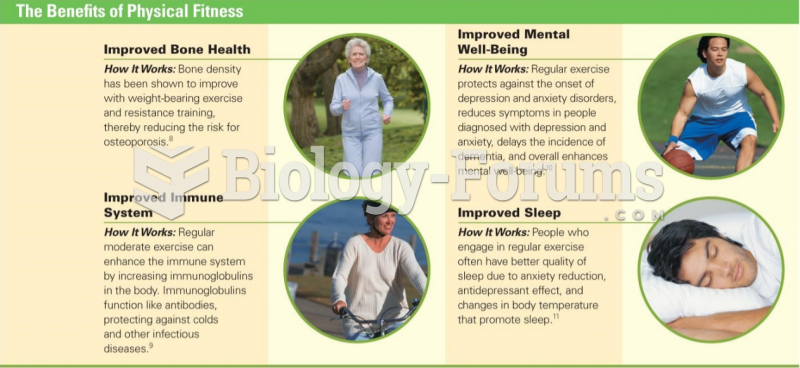

Bisphosphonates were first developed in the nineteenth century. They were first investigated for use in disorders of bone metabolism in the 1960s. They are now used clinically for the treatment of osteoporosis, Paget's disease, bone metastasis, multiple myeloma, and other conditions that feature bone fragility.

About 600,000 particles of skin are shed every hour by each human. If you live to age 70 years, you have shed 105 pounds of dead skin.

In 2012, nearly 24 milliion Americans, aged 12 and older, had abused an illicit drug, according to the National Institute on Drug Abuse (NIDA).

Elderly adults are at greatest risk of stroke and myocardial infarction and have the most to gain from prophylaxis. Patients ages 60 to 80 years with blood pressures above 160/90 mm Hg should benefit from antihypertensive treatment.

If all the neurons in the human body were lined up, they would stretch more than 600 miles.