|

|

|

Did you know?

Atropine was named after the Greek goddess Atropos, the oldest and ugliest of the three sisters known as the Fates, who controlled the destiny of men.

Did you know?

More than 2,500 barbiturates have been synthesized. At the height of their popularity, about 50 were marketed for human use.

Did you know?

Everyone has one nostril that is larger than the other.

Did you know?

According to the American College of Allergy, Asthma & Immunology, more than 50 million Americans have some kind of food allergy. Food allergies affect between 4 and 6% of children, and 4% of adults, according to the CDC. The most common food allergies include shellfish, peanuts, walnuts, fish, eggs, milk, and soy.

Did you know?

Cytomegalovirus affects nearly the same amount of newborns every year as Down syndrome.

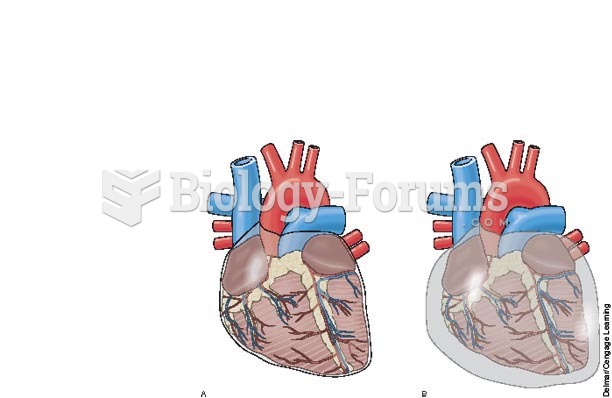

Pericardial effusion: A, normal pericardial sac; B, pericardial sac with excess fluid possibly causi

Pericardial effusion: A, normal pericardial sac; B, pericardial sac with excess fluid possibly causi

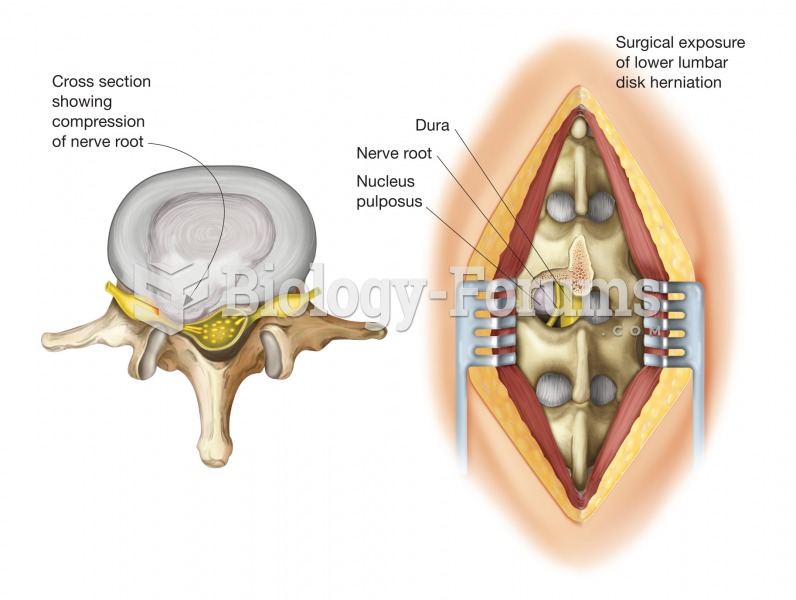

Herniated disk. A herniated disk is a protrusion of the disk’s gelatinous center, called the nucleus

Herniated disk. A herniated disk is a protrusion of the disk’s gelatinous center, called the nucleus