|

|

|

Drugs are in development that may cure asthma and hay fever once and for all. They target leukotrienes, which are known to cause tightening of the air passages in the lungs and increase mucus productions in nasal passages.

Approximately one in four people diagnosed with diabetes will develop foot problems. Of these, about one-third will require lower extremity amputation.

More than 2,500 barbiturates have been synthesized. At the height of their popularity, about 50 were marketed for human use.

Addicts to opiates often avoid treatment because they are afraid of withdrawal. Though unpleasant, with proper management, withdrawal is rarely fatal and passes relatively quickly.

Certain chemicals, after ingestion, can be converted by the body into cyanide. Most of these chemicals have been removed from the market, but some old nail polish remover, solvents, and plastics manufacturing solutions can contain these substances.

Functional MRI Scans These scans of human brains show localized average increases in neural activity

Functional MRI Scans These scans of human brains show localized average increases in neural activity

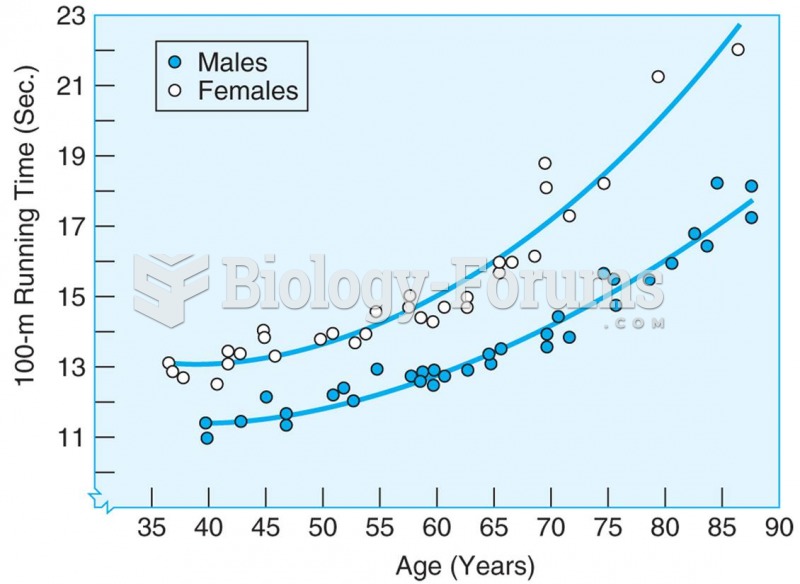

Running time on 100-meter sprint for men and women master athletes increases with age. Source: Korho

Running time on 100-meter sprint for men and women master athletes increases with age. Source: Korho