|

|

|

Did you know?

Calcitonin is a naturally occurring hormone. In women who are at least 5 years beyond menopause, it slows bone loss and increases spinal bone density.

Did you know?

The horizontal fraction bar was introduced by the Arabs.

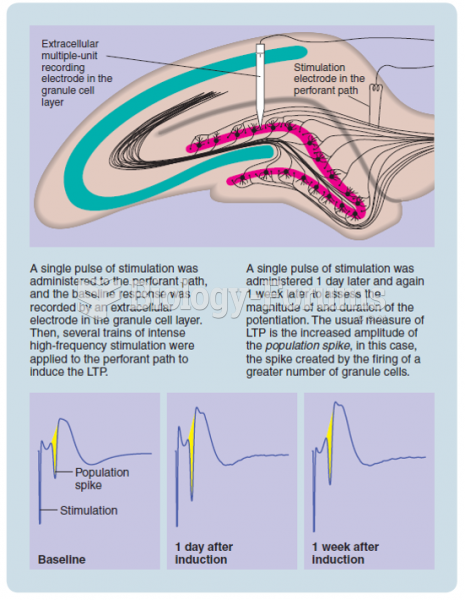

Did you know?

Many of the drugs used by neuroscientists are derived from toxic plants and venomous animals (such as snakes, spiders, snails, and puffer fish).

Did you know?

A headache when you wake up in the morning is indicative of sinusitis. Other symptoms of sinusitis can include fever, weakness, tiredness, a cough that may be more severe at night, and a runny nose or nasal congestion.

Did you know?

The FDA recognizes 118 routes of administration.