|

|

|

Cancer has been around as long as humankind, but only in the second half of the twentieth century did the number of cancer cases explode.

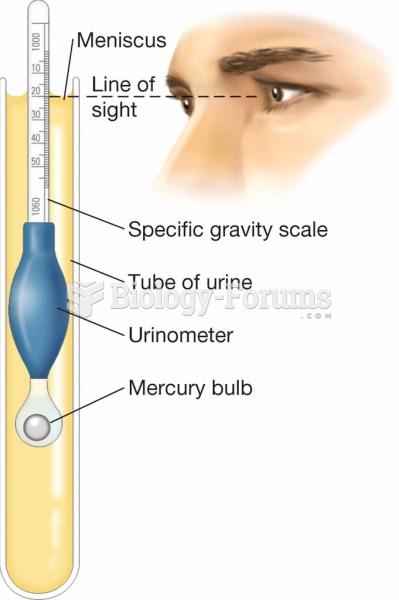

To maintain good kidney function, you should drink at least 3 quarts of water daily. Water dilutes urine and helps prevent concentrations of salts and minerals that can lead to kidney stone formation. Chronic dehydration is a major contributor to the development of kidney stones.

Many of the drugs used by neuroscientists are derived from toxic plants and venomous animals (such as snakes, spiders, snails, and puffer fish).

Your chance of developing a kidney stone is 1 in 10. In recent years, approximately 3.7 million people in the United States were diagnosed with a kidney disease.

Fatal fungal infections may be able to resist newer antifungal drugs. Globally, fungal infections are often fatal due to the lack of access to multiple antifungals, which may be required to be utilized in combination. Single antifungals may not be enough to stop a fungal infection from causing the death of a patient.