|

|

|

Your chance of developing a kidney stone is 1 in 10. In recent years, approximately 3.7 million people in the United States were diagnosed with a kidney disease.

The first war in which wide-scale use of anesthetics occurred was the Civil War, and 80% of all wounds were in the extremities.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

The first oral chemotherapy drug for colon cancer was approved by FDA in 2001.

All adults should have their cholesterol levels checked once every 5 years. During 2009–2010, 69.4% of Americans age 20 and older reported having their cholesterol checked within the last five years.

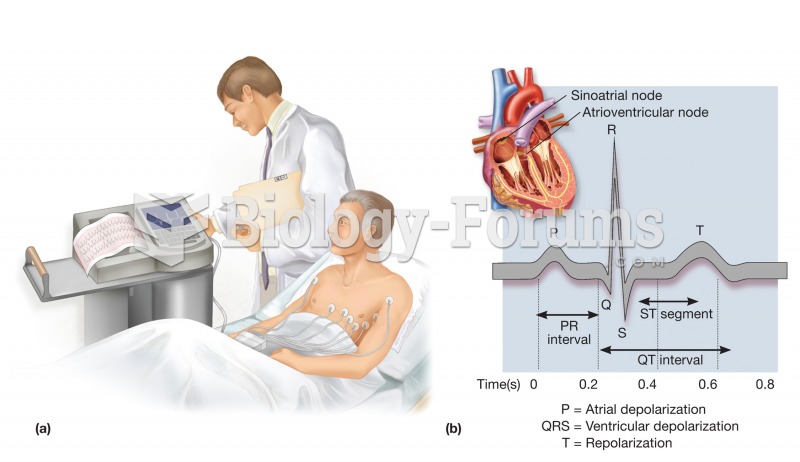

Electrocardiography. (a) Electrodes are placed on the patient’s chest to record the electrical event

Electrocardiography. (a) Electrodes are placed on the patient’s chest to record the electrical event

The Scopes Trial: William Jennings Bryan (right) represented the state of Tennessee, and Clarence Da

The Scopes Trial: William Jennings Bryan (right) represented the state of Tennessee, and Clarence Da