|

|

|

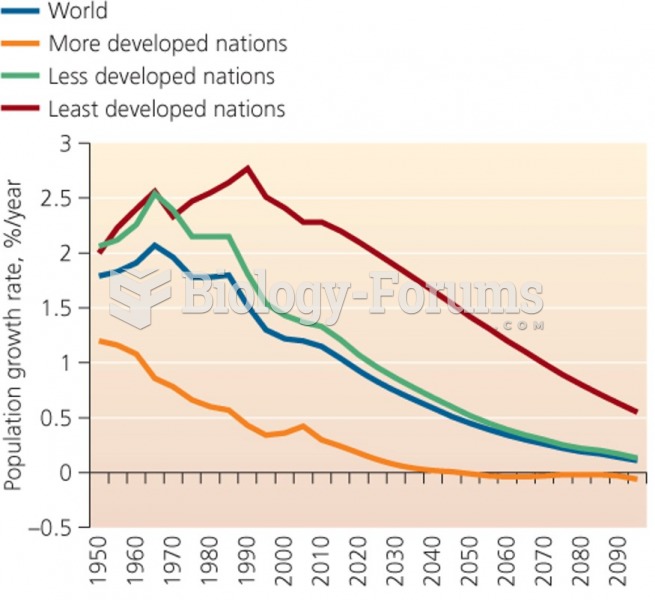

In the United States, there is a birth every 8 seconds, according to the U.S. Census Bureau's Population Clock.

The term bacteria was devised in the 19th century by German biologist Ferdinand Cohn. He based it on the Greek word "bakterion" meaning a small rod or staff. Cohn is considered to be the father of modern bacteriology.

Over time, chronic hepatitis B virus and hepatitis C virus infections can progress to advanced liver disease, liver failure, and hepatocellular carcinoma. Unlike other forms, more than 80% of hepatitis C infections become chronic and lead to liver disease. When combined with hepatitis B, hepatitis C now accounts for 75% percent of all cases of liver disease around the world. Liver failure caused by hepatitis C is now leading cause of liver transplants in the United States.

About 3.2 billion people, nearly half the world population, are at risk for malaria. In 2015, there are about 214 million malaria cases and an estimated 438,000 malaria deaths.

Although puberty usually occurs in the early teenage years, the world's youngest parents were two Chinese children who had their first baby when they were 8 and 9 years of age.