|

|

|

A good example of polar molecules can be understood when trying to make a cake. If water and oil are required, they will not mix together. If you put them into a measuring cup, the oil will rise to the top while the water remains on the bottom.

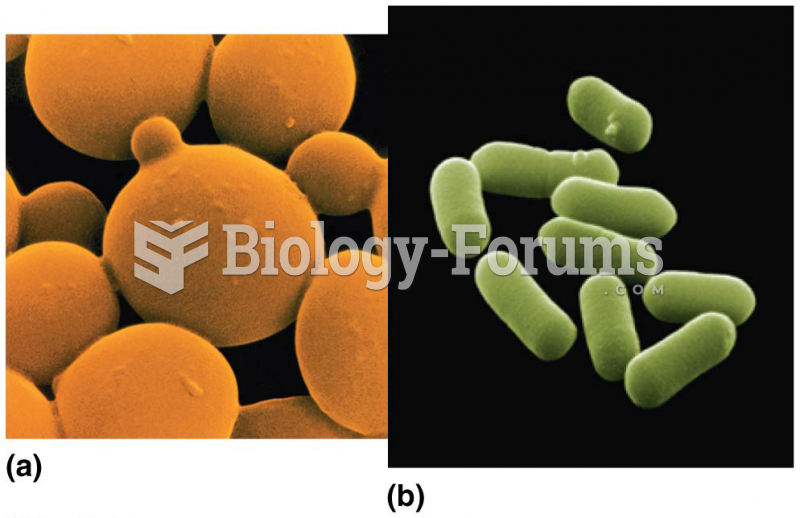

Blastomycosis is often misdiagnosed, resulting in tragic outcomes. It is caused by a fungus living in moist soil, in wooded areas of the United States and Canada. If inhaled, the fungus can cause mild breathing problems that may worsen and cause serious illness and even death.

Drug abusers experience the following scenario: The pleasure given by their drug (or drugs) of choice is so strong that it is difficult to eradicate even after years of staying away from the substances involved. Certain triggers may cause a drug abuser to relapse. Research shows that long-term drug abuse results in significant changes in brain function that persist long after an individual stops using drugs. It is most important to realize that the same is true of not just illegal substances but alcohol and tobacco as well.

By definition, when a medication is administered intravenously, its bioavailability is 100%.

Approximately 15–25% of recognized pregnancies end in miscarriage. However, many miscarriages often occur before a woman even knows she is pregnant.