|

|

|

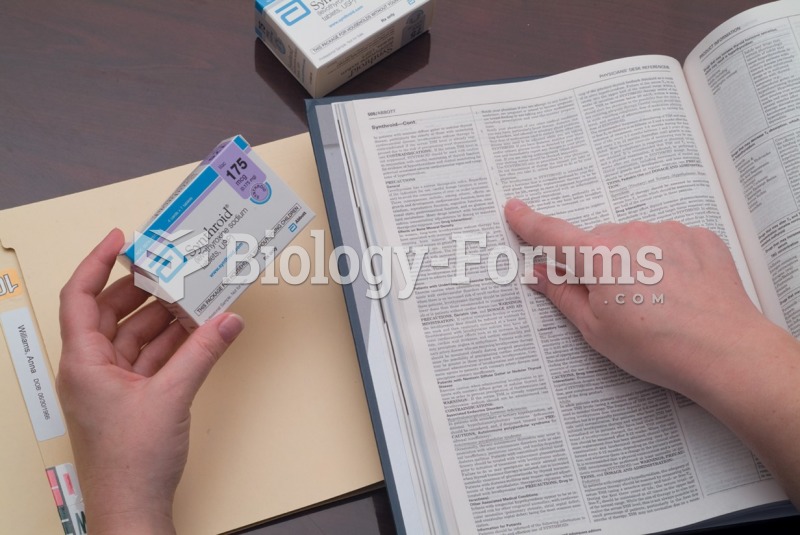

Hyperthyroidism leads to an increased rate of metabolism and affects about 1% of women but only 0.1% of men. For most people, this increased metabolic rate causes the thyroid gland to become enlarged (known as a goiter).

Stevens-Johnson syndrome and Toxic Epidermal Necrolysis syndrome are life-threatening reactions that can result in death. Complications include permanent blindness, dry-eye syndrome, lung damage, photophobia, asthma, chronic obstructive pulmonary disease, permanent loss of nail beds, scarring of mucous membranes, arthritis, and chronic fatigue syndrome. Many patients' pores scar shut, causing them to retain heat.

All patients with hyperparathyroidism will develop osteoporosis. The parathyroid glands maintain blood calcium within the normal range. All patients with this disease will continue to lose calcium from their bones every day, and there is no way to prevent the development of osteoporosis as a result.

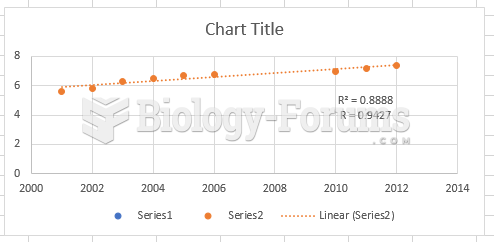

Between 1999 and 2012, American adults with high total cholesterol decreased from 18.3% to 12.9%

Children of people with alcoholism are more inclined to drink alcohol or use hard drugs. In fact, they are 400 times more likely to use hard drugs than those who do not have a family history of alcohol addiction.