|

|

|

About 80% of major fungal systemic infections are due to Candida albicans. Another form, Candida peritonitis, occurs most often in postoperative patients. A rare disease, Candida meningitis, may follow leukemia, kidney transplant, other immunosuppressed factors, or when suffering from Candida septicemia.

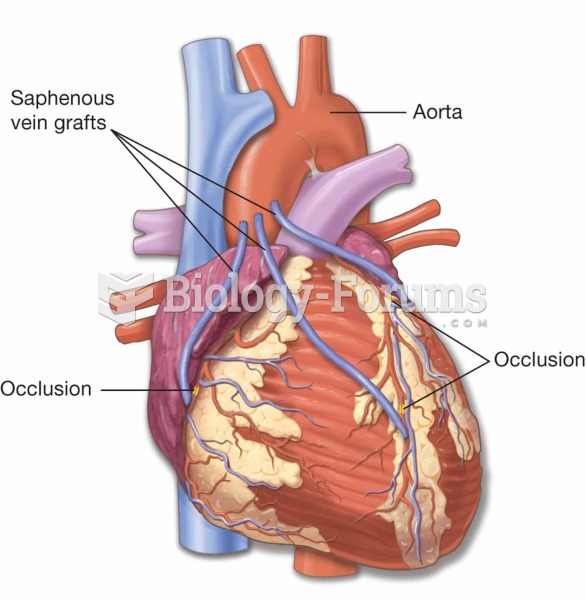

This year, an estimated 1.4 million Americans will have a new or recurrent heart attack.

The use of salicylates dates back 2,500 years to Hippocrates’s recommendation of willow bark (from which a salicylate is derived) as an aid to the pains of childbirth. However, overdosage of salicylates can harm body fluids, electrolytes, the CNS, the GI tract, the ears, the lungs, the blood, the liver, and the kidneys and cause coma or death.

Critical care patients are twice as likely to receive the wrong medication. Of these errors, 20% are life-threatening, and 42% require additional life-sustaining treatments.

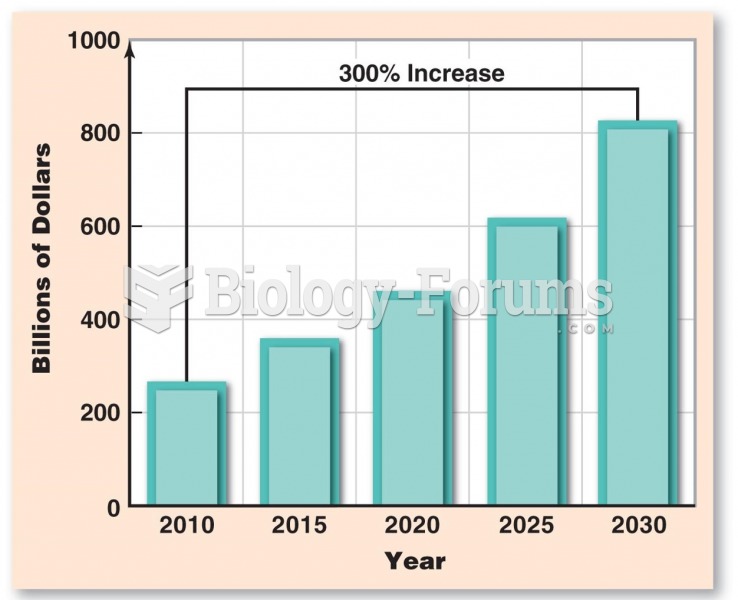

More than one-third of adult Americans are obese. Diseases that kill the largest number of people annually, such as heart disease, cancer, diabetes, stroke, and hypertension, can be attributed to diet.