|

|

|

Though the United States has largely rejected the metric system, it is used for currency, as in 100 pennies = 1 dollar. Previously, the British currency system was used, with measurements such as 12 pence to the shilling, and 20 shillings to the pound.

People often find it difficult to accept the idea that bacteria can be beneficial and improve health. Lactic acid bacteria are good, and when eaten, these bacteria improve health and increase longevity. These bacteria included in foods such as yogurt.

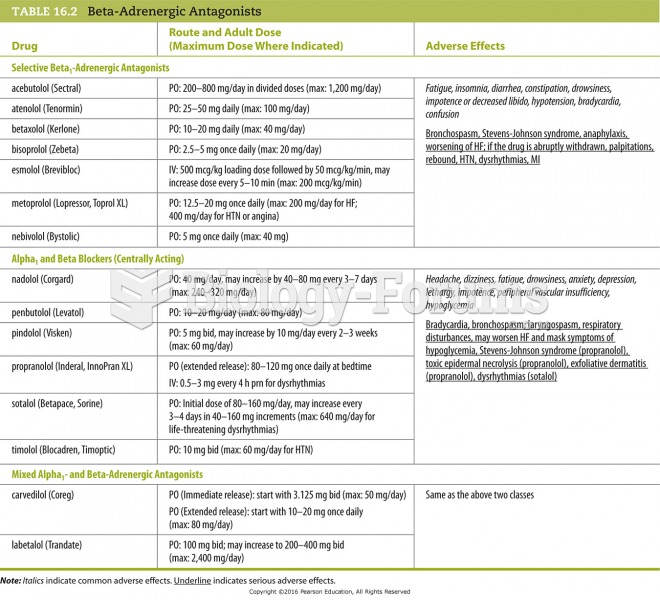

Patients should never assume they are being given the appropriate drugs. They should make sure they know which drugs are being prescribed, and always double-check that the drugs received match the prescription.

Automated pill dispensing systems have alarms to alert patients when the correct dosing time has arrived. Most systems work with many varieties of medications, so patients who are taking a variety of drugs can still be in control of their dose regimen.

Astigmatism is the most common vision problem. It may accompany nearsightedness or farsightedness. It is usually caused by an irregularly shaped cornea, but sometimes it is the result of an irregularly shaped lens. Either type can be corrected by eyeglasses, contact lenses, or refractive surgery.