|

|

|

The human body's pharmacokinetics are quite varied. Our hair holds onto drugs longer than our urine, blood, or saliva. For example, alcohol can be detected in the hair for up to 90 days after it was consumed. The same is true for marijuana, cocaine, ecstasy, heroin, methamphetamine, and nicotine.

People with high total cholesterol have about two times the risk for heart disease as people with ideal levels.

Hypertension is a silent killer because it is deadly and has no significant early symptoms. The danger from hypertension is the extra load on the heart, which can lead to hypertensive heart disease and kidney damage. This occurs without any major symptoms until the high blood pressure becomes extreme. Regular blood pressure checks are an important method of catching hypertension before it can kill you.

Recent studies have shown that the number of medication errors increases in relation to the number of orders that are verified per pharmacist, per work shift.

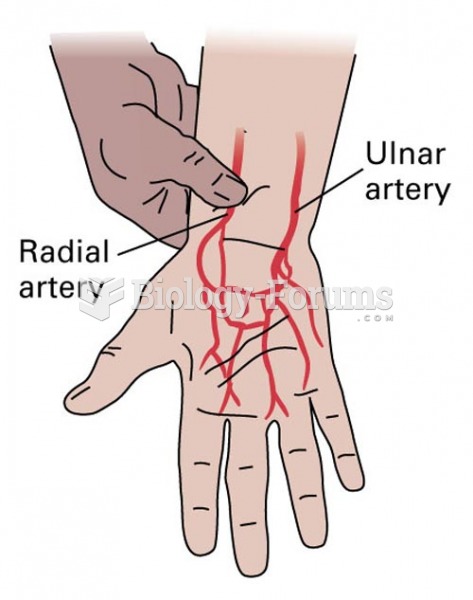

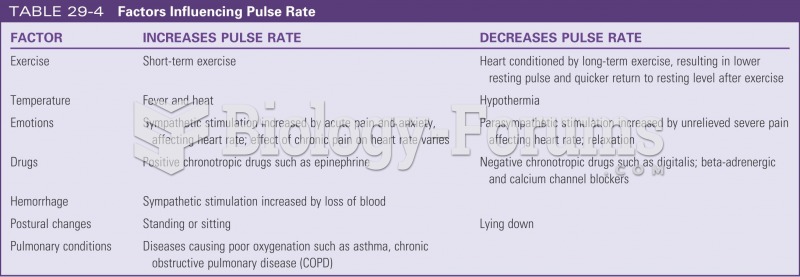

Vital signs (blood pressure, temperature, pulse rate, respiration rate) should be taken before any drug administration. Patients should be informed not to use tobacco or caffeine at least 30 minutes before their appointment.