|

|

|

IgA antibodies protect body surfaces exposed to outside foreign substances. IgG antibodies are found in all body fluids. IgM antibodies are the first type of antibody made in response to an infection. IgE antibody levels are often high in people with allergies. IgD antibodies are found in tissues lining the abdomen and chest.

Stroke kills people from all ethnic backgrounds, but the people at highest risk for fatal strokes are: black men, black women, Asian men, white men, and white women.

When blood is deoxygenated and flowing back to the heart through the veins, it is dark reddish-blue in color. Blood in the arteries that is oxygenated and flowing out to the body is bright red. Whereas arterial blood comes out in spurts, venous blood flows.

Though newer “smart” infusion pumps are increasingly becoming more sophisticated, they cannot prevent all programming and administration errors. Health care professionals that use smart infusion pumps must still practice the rights of medication administration and have other professionals double-check all high-risk infusions.

Cocaine was isolated in 1860 and first used as a local anesthetic in 1884. Its first clinical use was by Sigmund Freud to wean a patient from morphine addiction. The fictional character Sherlock Holmes was supposed to be addicted to cocaine by injection.

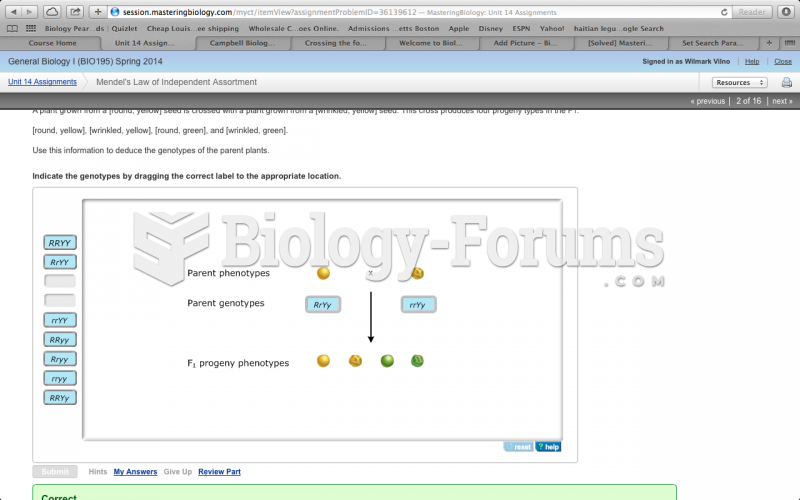

Transdermal patch administration: (b) patch immediately applied to clean, dry, hairless skin and lab

Transdermal patch administration: (b) patch immediately applied to clean, dry, hairless skin and lab

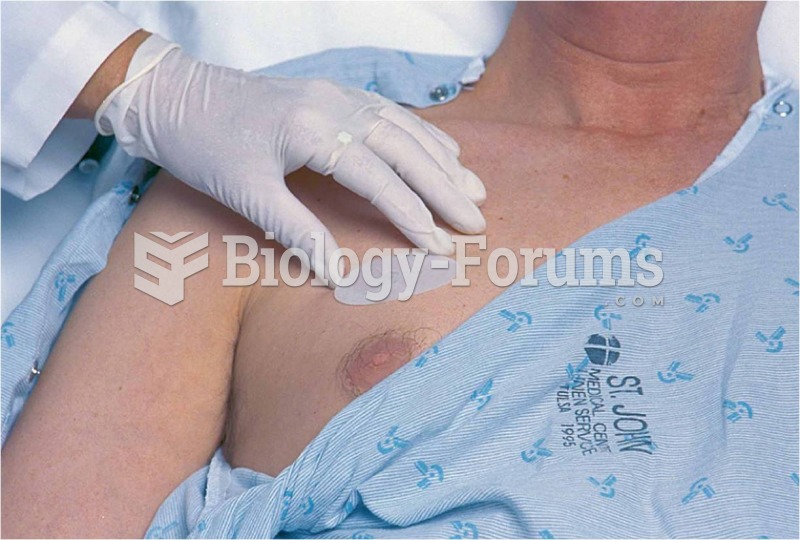

Intradermal drug administration: (b) the administration site is prepped Source: Pearson Education/PH

Intradermal drug administration: (b) the administration site is prepped Source: Pearson Education/PH